Tax Refund Guide for Foreign Shoppers in Korea

To make your shopping experience more enjoyable and cost-effective, we’ve put together this "Tax Refund Guide for Foreign Shoppers in Korea." This guide will provide detailed information on Korea's tax refund policies, eligibility, refund procedures, and important tips to ensure you can claim your tax refund with ease while shopping in Korea.

1. Overview of Tax Refund Policy

Korea's tax refund policy is designed to attract foreign tourists, allowing you to enjoy more benefits while shopping. Below are the key details of the tax refund policy:

- Eligible Applicants: Foreigners (non-Korean nationals) entering Korea on a short-term visa (e.g., tourist visa), and overseas residents of Korean nationality who have lived abroad long-term.

- Minimum Spending Amount: A single purchase of at least 15,000 KRW (approximately 10.4 USD) is required to apply for a tax refund.

- Refund Amount: Generally 3%-7% of the product price, depending on the type of goods and the total amount spent.

- Time Limit for Departure: You must leave Korea within 90 days of purchase to qualify for a tax refund.

- Stay Duration Restriction: Foreigners (non-Korean nationals) who stay in Korea for less than 6 months, as well as Korean nationals living overseas for more than 2 years or with permanent residency abroad and residing in Korea for less than 3 months, are eligible for a tax refund.

- Maximum Spending Limit: Tax exemption applies only to purchases within a single entry totaling up to 5,000,000 KRW.

- Important Notes: For high-value goods, you may need to declare them at customs upon departure. Be sure to keep all relevant documents.

2. Who Cannot Enjoy Tax Refunds

- Korean Citizens: Individuals holding Korean nationality are not eligible for tax refunds.

- Long-Term Residents: Foreigners staying in Korea for more than 6 months (e.g., holders of work or student visas).

3. Calculation of Tax Refund Amounts

Tax refund amounts may vary depending on the total spending and the type of goods, generally ranging from 3%-7% of the product price. Here are some specific examples:

- Spending 50,000 KRW: Refundable amount is approximately 1,500-3,500 KRW (around 1.04-2.43 USD).

- Spending 300,000 KRW: Refundable amount is approximately 9,000-21,000 KRW (around 6.24-14.55 USD).

Note: Only the portion of total spending within 5,000,000 KRW per entry is eligible for a tax refund.

4. Tax Refund Process (Airport Refund)

Step 1: While Shopping (e.g., in Myeongdong)

- Shop at stores displaying the "Tax Free" logo.

- Inform the cashier that you need a tax refund and provide your passport details.

- The cashier will issue a tax refund receipt. Keep it safe .

Step 2: Tax Refund at the Airport

- Before Security Check: Submit your refund application at a KIOSK machine.

KIOSK machines are located near check-in counters J or E, or near security gates 3 and 4 at Incheon Airport. Follow the instructions: scan your passport, confirm your refund details, and obtain a refund ticket (the ticket indicates that you can claim the refund after passing security).

- After Completing Refund Registration, non-high-value duty-free items can be checked in.

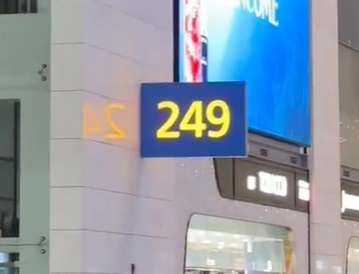

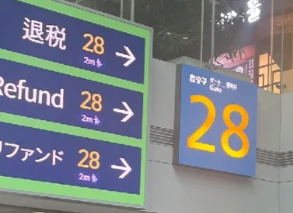

- After Security Check: Proceed to Gate 249 or Gate 28 and find a TAX REFUND machine to process your refund.

Step 3: Scan Your Passport and Follow Instructions

- Choose either a cash refund (KRW or foreign currency) or a credit card refund.

- Non-high-value duty-free items (refund under 75,000 KRW): Use the self-service refund machine.

- High-value duty-free items (refund over 75,000 KRW): Follow the machine’s prompts to have customs officers verify the items before processing the refund.

Note: High-value refund items should be carried as hand luggage instead of being checked in, as customs may inspect them.

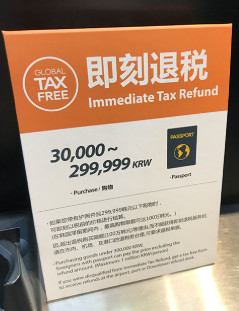

5.Tax Refund Process (Instant Refund in Stores)

- Some stores offer instant tax refund services, allowing you to deduct the tax directly at the time of purchase without needing to process it at the airport.

- You will need to provide your passport and flight departure details.

Example: Stores like Olive Young and Hyundai Department Store with "Instant Tax Refund" signage.

When checking out, inform the staff that you need a tax refund ("Tax Free") and provide your passport and flight departure information to complete the refund.

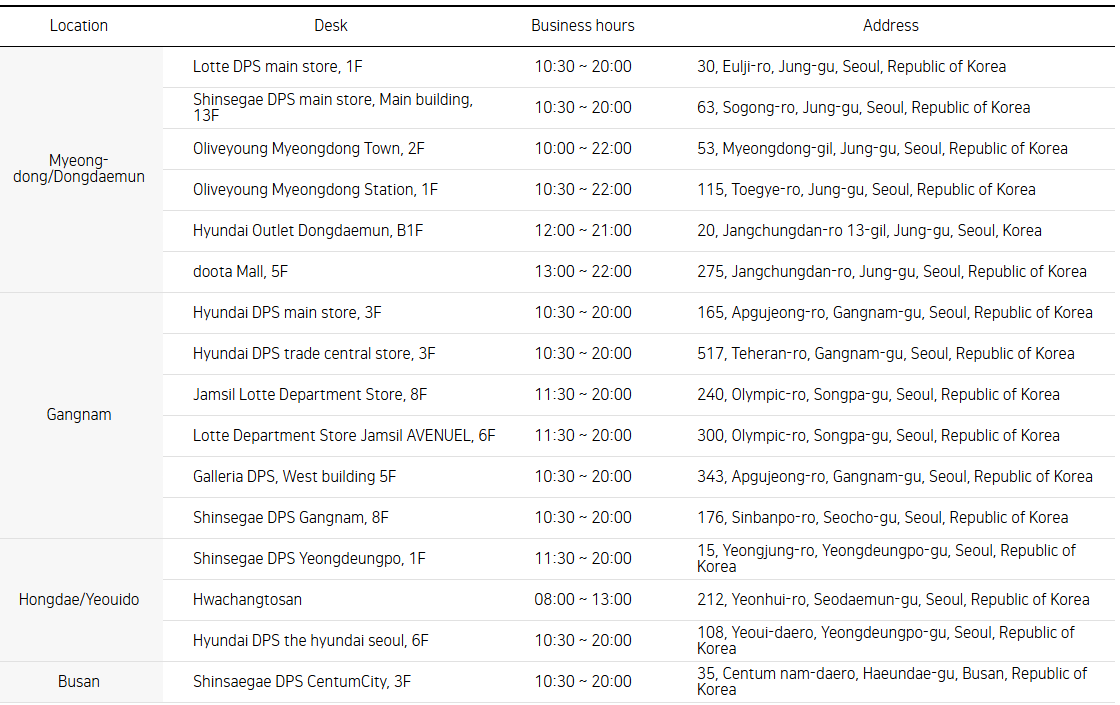

6. Tax Refund Process (Recommended Refund Locations in Seoul)

Seoul's main tax refund locations and business hours (GLOBAL TAX FREE):

To make it more convenient for travelers to complete their tax refunds, Korea's GLOBAL TAX FREE company has set up multiple refund counters and Tax Refund Kiosks in the city. You can choose between cash refunds or credit card refunds. However, regardless of the method you choose, you must bring your tax refund receipt, passport, and credit card to process the refund and meet the following conditions:

- Minimum purchase amount per transaction: A minimum spending of 15,000 KRW is required.

- Maximum spending limit: The total amount spent during your stay must not exceed 5,000,000 KRW.

- For single purchases over 1,000,000 KRW (refund amount over 75,000 KRW):

- High-value tax-free items require processing at a manned counter.

- Bring unopened products for customs inspection.

- For single purchases under 1,000,000 KRW (refund amount not exceeding 75,000 KRW):

Use a Tax Refund Kiosk directly for processing without needing manual service.

Notes:Refund rates: The refund amount depends on the total spending and the type of goods purchased!!!

Attention!!!

Regardless of whether you have completed your tax refund in the city, you must follow these steps after completing check-in at the airport:

Use the Self-Service Tax Refund Kiosk

Scan your passport and tax refund receipts to complete exit verification.

Manual Tax Refund Counter

Visit the refund counter to have staff confirm and finalize the exit verification process.

7. Items to Prepare

To ensure a smooth tax refund process, please prepare the following items in advance:

- Passport: Required for shopping and tax refund applications.

- Tax Refund Receipt: Request this from the store staff during your purchase and keep it safe.

- Purchase Receipt: Necessary for the tax refund process.

- Credit Card: Required if you opt for a credit card refund.

- Goods (for high-value tax-free items): High-value tax refund items must be carried with you for potential customs inspection.

8. Notes

- Keep Receipts: You must provide purchase receipts for tax refunds; keep them safe.

- Goods Inspection: Customs may check tax refund items; place them in an easily accessible location.

- Time Management: The tax refund process can take time; arrive at the airport 3-4 hours early.

- Duty-Free Shopping: Purchases at duty-free stores (e.g., Lotte Duty-Free, Shilla Duty-Free) are already tax-free, requiring no further refund.

- Policy Changes: Tax refund policies may change; confirm the latest details through the Korea Customs Service website or duty-free store customer service before your trip.

9. FAQs

- Is there a limit to the tax refund amount?

- Single-item purchases under KRW 1,000,000 (approx. USD 850) are considered non-valuable tax-free goods and can be refunded via self-service. Higher amounts require manual confirmation.

- Tax refunds apply only to total purchase amounts within KRW 5,000,000 per entry.

- Can tax refund items be checked in?

- Customs may inspect tax refund items, so it’s recommended to carry them with you. Non-valuable tax-free goods can be checked in.

- What if the tax refund fails?

- Contact airport staff or tax refund company customer service (e.g., Global Blue) for assistance if your refund fails.

10. Conclusion

Korea’s tax refund policy offers tangible benefits to foreign tourists. As long as you meet the requirements and follow the procedures, you can easily enjoy the tax refund service. I hope this guide helps make your shopping experience in Korea stress-free and cost-effective!